Project Summary

This research focuses on the lack of financial inclusion among housemaids in urban India and provides solutions that can be used by institutions promoting financial inclusion as well as by the general population interested in contributing to this cause. A primary survey was conducted that focused on 120 housemaids in Jodhpur city. The survey was able to capture financial behavior of the target population. It also brought forth real life stories of generational uplift with financially inclusive behavior as well as despairing spirals of poverty with poor financial decision making.

This research identifies key factors that influence financial inclusiveness among housemaids. It also offers a unique model, which is simple yet powerful and predicts financial engagement levels among this target population – a handy tool for banks and post offices to direct their efforts where they can reap results. I have also made recommendations to government bodies for actions and policies in this direction.

Birthed on the back of this research is a pilot initiative we have started in Jodhpur, promoting savings among housemaids through education and co-saving incentives, an initiative that hopefully everyone can take inspiration from.

Project Context

This research has been conducted in Jodhpur city in Rajasthan, India, my birthplace and with which I have always felt a deep connection. While Mehrangarh Fort stands as the pride of the city, Jodhpur is also known for its sweet dialect of Marwari and the spicy Mirchi Bada!

I have worked outside India as a consultant on innovation for almost a decade now, but recently I got a chance to live in the city for a year, due to the pandemic. My mom, who is a social activist, had been pushing the maids in our house to start saving – apparently, they did not have ANY savings! Their discussions caught my attention and planted the seeds for this research. Over the course of the next 6 months, I had the privilege to closely interact with the housemaids in Jodhpur city, talking to them about their lives, savings practices, spending behaviors and plans for the future. In my view, they are a happy-go-lucky lot, who are working hard but aimlessly; they plan their lives one day at a time. This research aims to bring their financial behaviors to the forefront, and make validated recommendations about how their financial behaviors can be changed for the better. With statistics and my own experience as proof of concept, I now want to share my key learnings with a broader audience to create a movement towards Financial Inclusion.

Research Goal, Method, and Outcome

Background and Rationale

Shanti and Pushpa (pseudonyms), were both struck by unforeseen and unfortunate events in their lives – while Shanti’s husband did not return (forever) from work one day, Pushpa lost her husband to elephantiasis. Both had adult kids to support. But while Shanti, with some support from her parents, turned to the formal financial system for help and took a small loan from a microfinance bank, Pushpa had to opt for the informal financial system and borrow money from money lenders in her community. Fast forward a few years, Shanti had gotten her kids’ schooling on track, was able to pay the loan installments on time, and in turn set herself well for another loan to meet the needs of the family. Pushpa, on the other hand, was not able to repay the loan due to the exorbitant interest rate, took another loan to pay her first one and had to stall her daughter’s education. These are stories of real people, and the level of Financial Inclusion was a key differentiator in how the lives of these two brave women panned out.

What is Financial Inclusion and Why does it Matter?

Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way[1]. Financial Inclusion, especially from the use of digital financial services, including mobile money services, payment cards, and other financial technology (or fintech) applications, has shown potential for many development benefits like reducing poverty, accumulating savings, reducing debt, increasing spending on necessities and better equipping people to manage financial risk[2].

Thinking of India, there are many employment sectors which, although are financially weak today, have the potential to quickly become stronger if they embrace financial inclusion. Housemaids are one example. This segment is highly unorganized and often financially exploited. That said, they do generate some savings on a monthly basis, which they end up spending on trivial things rather than saving. Most of the housemaids are not active with the formal financial system (banks or post offices). This means they turn to private money lenders when they need a loan. They get loans at exorbitant interest rates (typically > 50%), and keep getting poorer in repaying such loans. Stronger financial discipline and access to useful and affordable financial products and services that meet their needs holds a good chance to help housemaids out of poverty and give hope to future generations.

To achieve universal financial inclusion, the first milestone put forward by the World Bank was achieving Universal Financial Access (UFA; having access to an account in a formal financial institution like a bank or post office), with this milestone to be reached by 2020. This initiative has seen remarkable success over the last decade[3]. However, many of those who now have access don’t have an active account.

The Indian Government launched its efforts for financial inclusion in 2014. Three years from launch, 80%2 of Indian adults had a bank account. But 58%2 of them had made no withdrawal or deposit in the past year and thus they are considered to have “inactive accounts.” This suggests that financial engagement is a critical next step in the goal towards financial inclusion. Given this context, a framework that can identify key social, economic and/or demographic factors that influence the propensity of a person to become financially engaged (in the formal financial system) and can predict the level of financial engagement can be very beneficial for multiple stakeholders. My research strives to do just that, with a focus on a specific employed group, housemaids. Given that the profession of housemaids is dominated by women, it will also give us an opportunity to uncover ways to move the needle on financial inclusion for working women from a lower socio-economic class, from the informal sector.

Method

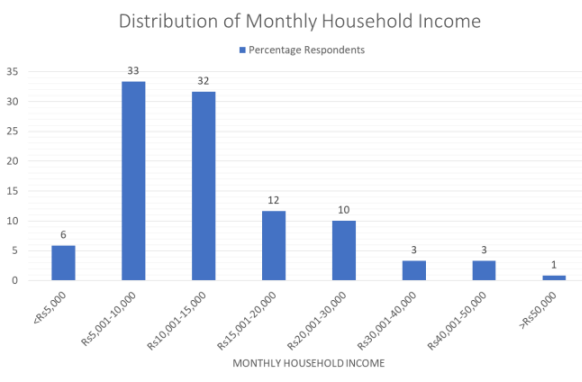

We interviewed 120 domestic housemaids/helpers (15+ years of age) in the city of Jodhpur in Rajasthan (India). The financial status of this sample group is weak, with 70% having a monthly household income of <= Rs15,000 while the median family size is 5-6 members (Rs = Indian currency, Rupee). Figure 1 below demonstrates the spread of personal monthly income in this group.

Figure 1

Distribution of Monthly Household Income

One in two of those interviewed have taken active loans, most of them at exorbitant interest rates (> 50%) from informal channels like relatives or money lenders. More often than not, such loans eat into whatever little savings they have and launch them into a downward spiral of poverty. 40% of those interviewed claim they don’t save at all. That said, the informal financial system (chit fund[4]) is quite commonly used for saving by the housemaids’ community in Jodhpur and many use it to ensure they can get a lump sum of money during critical life events and stages (like marriage, death, birth of child, etc.) or family emergencies.

The research team captured individual responses to a range of social, economic, demographic and intermediate variables like age, gender, monthly income and access to financial services. These variables were finalized based on past research in this sector, and the research team’s own understanding of the parameters that feed into lack of financial inclusion among this segment. For example, addition of economic variables like Personal and Household monthly income was inspired by past research work[5] but addition of another economic variable, Savings per month, was based on research team’s own observation of the financial approach of housemaids – to save is not a default practice in this community and is not directly correlated to monthly income. It, therefore, warranted entry as a separate variable in the model.

The independent variables used in the analysis are as below:

- Demographic: Age, Gender, Marital Status, Size of family, Education level of self

- Social: Education level of spouse, Type of House, Household amenities, Aspirations about future, Priorities when thinking about spending money

- Economic: Personal monthly income, Household monthly income, Savings per month

- Intermediate: Proximity to a financial institution, Access, Awareness and Interest in using formal financial services

We also derived the level of financial engagement at an individual level, captured as Financial Engagement Score per respondent. This was done by enquiring whether the respondent has a bank/post office account, how frequently it is accessed, for what purposes and if the respondent has any digital finance apps on his/her mobile. Two levels of financial engagement were assessed:

Level 1 – Not Engaged (Unbanked or Banked but not Engaged)

Level 2 – Engaged (Banked and Engaged)

A predictive model was developed using SPSS software, where level of financial engagement (Financial Engagement Score) was the dependent variable and the social, economic, demographic and intermediate factors were the independent variables.

Key Findings

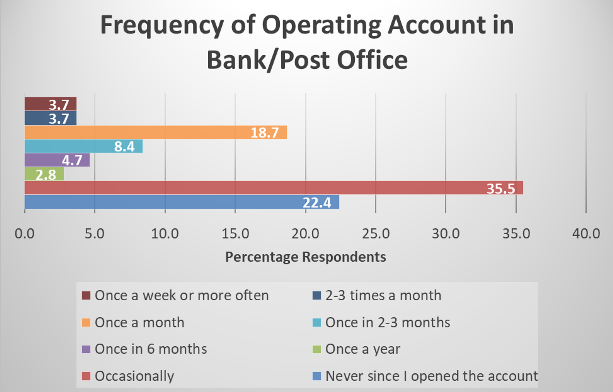

Encouragingly, 88% of the housemaids included in the research have an account in a bank or a post office. But 60% operate their account only occasionally or have never operated it since it was opened. Figure 2 captures the depth of account usage among this group.

Figure 2

Frequency of Operating Account in Bank/Post Office

In many cases, these accounts were opened by the housemaids to avail themselves of a government payout which was being offered as an incentive to open the accounts. In essence, a lot of the housemaids are now stuck in Level 1 (Banked but not Engaged) on the Financial Engagement scale, and need to be moved to Level 2, towards being engaged. The Financial Inclusion Model can help guide the way forward.

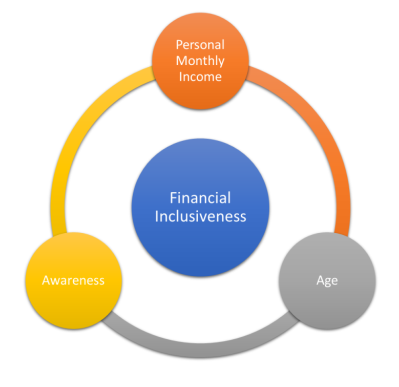

Of approximately 20 variables fed into the model, only three were key to predicting the financial behavior of an individual in this segment:

- Personal Monthly Income. This is the most important factor; those earning higher than Rs10,000 per month are 7 times more likely to be financially engaged. Unfortunately, 85% of the respondents in this survey earn <= Rs10,000 per month.

- Age. Propensity to be financially engaged is expected to increase with age and maturity, before it dips again for old people.

- Awareness. A person broadly aware of key financial services offered by banks and post offices (like savings accounts, current accounts, interest rates, ATM cards, etc.) is 2.3 times more likely to be financially engaged than someone who is not aware.

These three factors, therefore, form the Financial Inclusion Model which has been visually presented in Figure 3 below.

Figure 3

The Financial Inclusion Model

The Regression Equation:

ln[p/(1-p)] = 1.977 + 1.955*(Personal Monthly Income) + 0.041*(Age) + 0.87*(Awareness)

where, p = Probability of an individual to be at Level 2 (Engaged).

Sample outputs:

|

Scenario |

Probability of a person to be at level 2 |

|

Low income, young, less aware |

22% |

|

High income, young, less aware |

67% |

|

Low income, older, less aware |

42% |

|

Low income, young, more aware |

41% |

Key Recommendations

A. For Bank/Post Office:

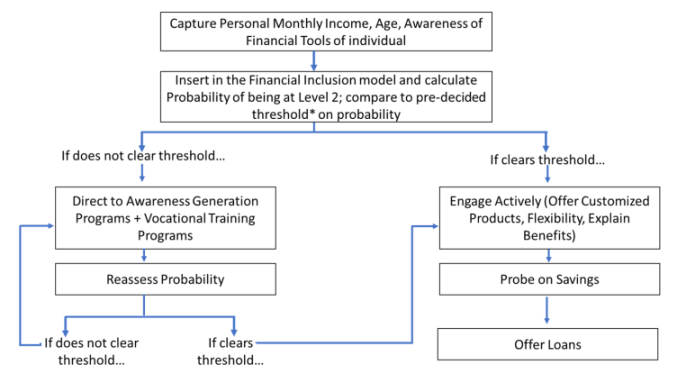

- Use the model to screen new applicants and existing accounts from the weaker socio-economic class, housemaids in particular. Figure 4 below summarizes the approach that can be taken.

Figure 4

Using the Financial Inclusion Model to Manage Customers

*The model will give the probability of the individual to be at Level 2. Each organization will have to decide what level of certainty/probability they are comfortable with to engage actively with the individual.

2. Revisit loan policies to meet the need for lump sum money (for one time big expenses like marriage, delivery of a child, death) at a low or no interest rate. This need is currently addressed by informal financial tools (like the chit-fund). Appropriate loan policies can increase engagement of this segment of the population with the formal financial system.

B. For Government:

- Awareness Generation Programs: Local governments can actively invest in designing and executing such programs. These programs need to be locally executed, making people aware of financial tools at their disposal, promoting the idea of savings and addressing their concerns with the formal financial system. Currently, a lot of housemaids have sizable sums invested in the informal financial sector but hesitate to get involved with the formal financial sector due to lack of awareness of the formal sector’s tools or fear of rejection by the sector.

- Wider network of government appointed point-of-contacts (POCs): to provide reliable and timely guidance. Equity Bank in Kenya[6] provides an interesting idea to explore; it has adopted agent banking, which employs small retailers as agents that can collect deposits, issue withdrawals, and process loan payments.

- Minimum Wage Standardization: This method may need to be revisited. As a case in point, median monthly income of respondents in this survey is at par with government issued guidelines[7], but lower than what is needed to drive financial inclusion.

- Vocational Training for housemaids: Vocational training (e.g., stitching, snack making, etc.), organized via free or subsidized training camps can help increase their monthly income.

C. For Technology Companies:

Technological interventions have a proven track record of promoting financial inclusion and are much needed to drive developmental benefits of financial inclusion like reducing poverty, accumulating savings and increasing spending on necessities. M-Pesa (mobile payments wallet) in Kenya and SureCash (online payment platform for mobile phone users which offers other financial services) in Bangladesh are some successful examples. India needs such a push too. Increasing access to smartphones and devising digital finance platforms that can work with basic mobile phones could be good first steps. Ongoing World Bank programs like FSAP (Financial Sector Assessment Programs), HIFI (Harnessing Innovation for Financial Inclusion) and FIGI (Financial Inclusion Global Initiative) may also be leveraged to get technical assistance and funding in the journey towards digitization, policy reforms and open access to a wider array of financial services[8].

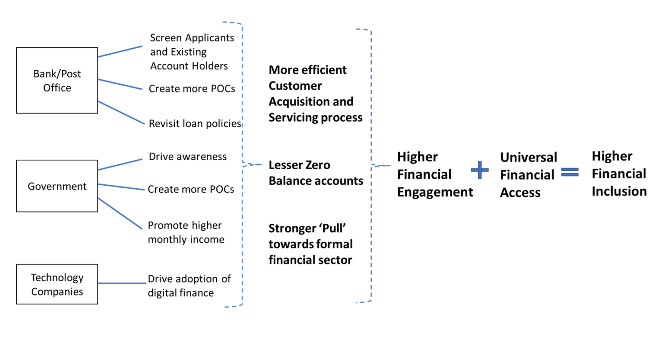

Together these actions by various stakeholders will drive Financial Engagement, which together with Financial Access, will lead us towards the ultimate goal of Financial Inclusion, a vision which is being passionately pursued by the World Bank. Figure 5 below encapsulates this vision.

Figure 5

The Financial Inclusion Model: Stakeholders and Impact

*POCs = Points of Contacts

Conclusions and Reflection

The findings from this research were an eye opener for me. We often underestimate the power of awareness. But the Financial Inclusion Model told me otherwise and pushed me to challenge the status quo. I along with my family have started a small initiative, called Prayaas, in which we are co-creating savings for women domestic helpers. Our main job? – Drive awareness and motivate! We educate housemaids about select government schemes and help with the paperwork to start a savings account in a post office. We also motivate them to continue saving and incentivise them (only a little bit) if they do so. Power of Awareness surprised me – in just about 6 months, 30 long term savings accounts owned by domestic helpers are up and running – 30 lives moving towards a better future. And all it took was one hour worth of work per week and a desire to create a better future for our society.

A Special Note of Thanks to:

Professor Xavier Raj, Consultant at Loyola College Society, Chennai, India: He kindly played the role of being my mentor in this project, making sure I remain focused on the big picture and actionability of the findings. His vast experience in the social impact sector made sure I remain true to the topic and understand it granularly.

Mrs. Gayatri Khetawat, Social Entrepreneur, B.A. (Home Science), My Mom!: Her work with housemaids over the years inspired the topic for this research. She also kindly coordinated the primary research and ran the pilot exercise with housemaids (referenced in this research) to encourage them

Footnotes

[1] https://www.worldbank.org/en/topic/financialinclusion/overview

[2] https://globalfindex.worldbank.org/#GF-ReportChapters

[3] https://www.worldbank.org/en/topic/financialinclusion/brief/achieving-universal-financial-access-by-2020

[4] A chit fund is a rotating saving scheme that has been a part of India’s financial system for more than a century now. A group of people contribute periodically towards the chit value for a duration equal to the number of investors (members or subscribers). The amount collected is given to the person, who is either selected through a lucky draw (lottery system) or an auction. The type of chit fund popular among the sample group for this study is Unregistered-Organized chit fund. This type of chit fund requires all the members to come together on a monthly or weekly basis. The names of all the members are written on small paper slips and collected in a box. The person in charge of the group picks up a paper slip in front of all the group members. The name picked up gets the whole collection of funds. That name is then removed from the box. For the next meeting, even though the member’s name will not be selected again, he/she has to be present and contribute their share of the money. Source: https://moneyclubber.com/blog/chit-fund/

[5] (a) Normative Constraints to Women’s Financial Inclusion: What We Know and What We Need to Know; https://content.centerforfinancialinclusion.org/wp-content/uploads/sites/2/2021/07/Normative-Constraints-to-Women’s-Financial-Inclusion_FINAL.pdf; (b) Chandrasekhar Balasubramanian (2015). Predicting regular saving behaviour of the poor using decision trees. Scholedge International Journal of Management and Development, 2(8), 16-30.

[6] Case study by UNCDF: Increasing Financial Inclusion in East Africa: Equity Bank’s Agent-driven model, by Ann Duval.

[7] https://www.india-briefing.com/news/guide-minimum-wage-india-2021-19406.html/

[8] https://www.worldbank.org/en/topic/financialinclusion/overview#2

To cite this work, please use the following reference:

Khetawat, R. (2022, January 4). A Framework for Predicting Financial Engagement and Promoting Financial Inclusion among Housemaids. Social Publishers Foundation. https://www.socialpublishersfoundation.org/knowledge_base/a-framework-for-predicting-financial-engagement-and-promoting-financial-inclusion-among-housemaids/